Amending the VAT Rate on Stock Records

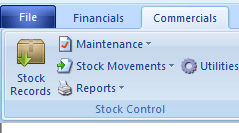

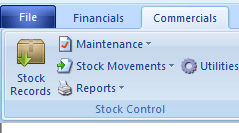

Navigate to Commercials -> Stock Records

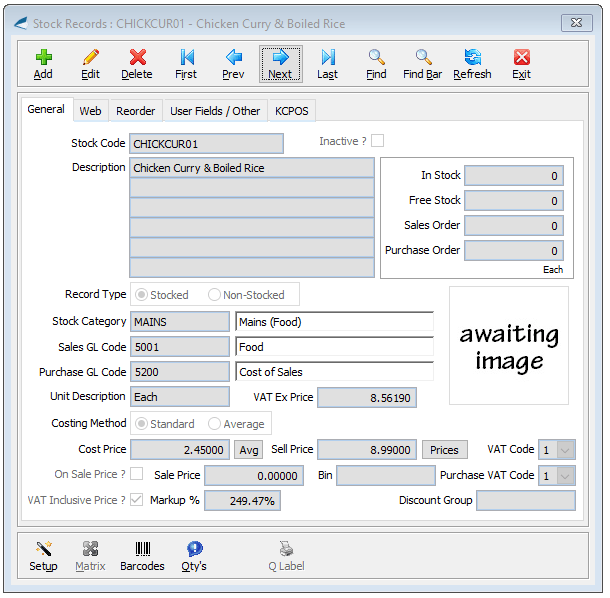

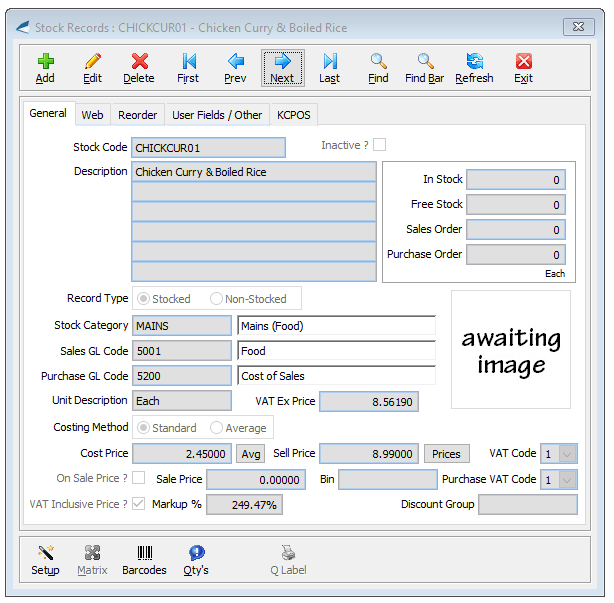

Use the Prev / Next buttons or the Find option to locate the item you wish to change the VAT Rate on.

Amending the Sell Price on Stock Records

Navigate to Commercials -> Stock Records

Use the Prev / Next buttons or the Find option to locate the item you wish to change the Sell Price on.

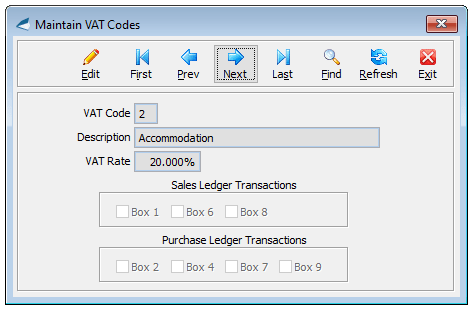

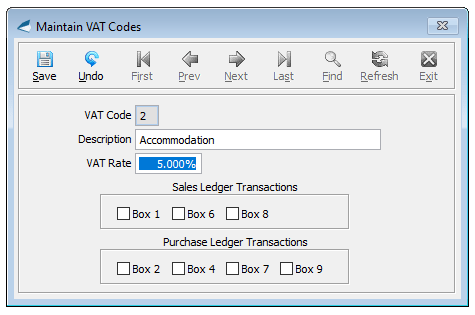

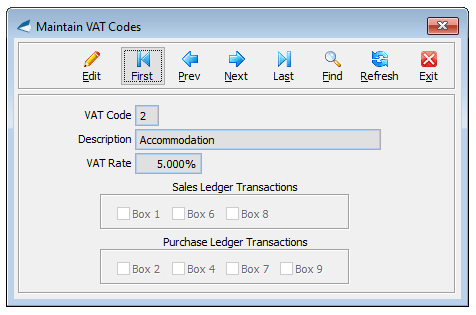

Amending an Existing VAT Rate

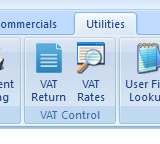

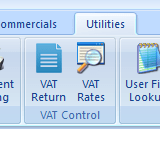

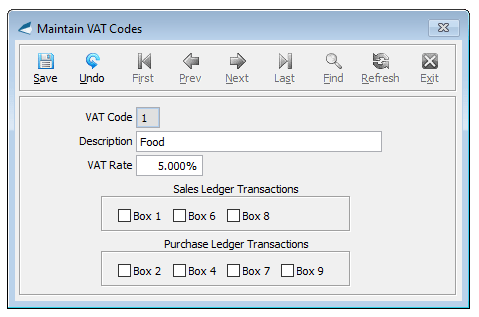

Navigate to Utilities -> VAT Control -> VAT Rates

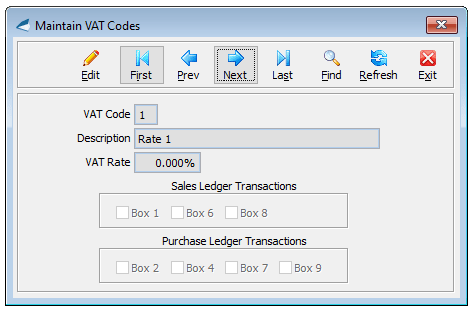

Use the Prev / Next buttons, or use the Find option to locate the VAT rate you wish to amend.

Click Edit and amend the necessary information.

Click Save to update the record.

Bulk Updating Prices

Sell Prices on Stock records can be amended in several ways, but a time saving option is to use the Stock Import / Export functionality.

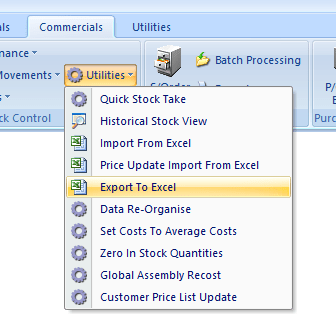

Firstly you need to export the stock to an Excel spreadsheet. You can do this by going to Commercials -> Stock Control -> Utilities -> Export to Excel.

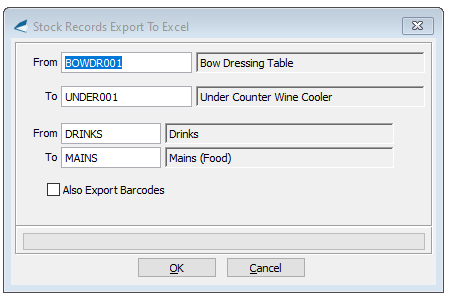

You can choose to only export a range of stock records based on code and category:

Click Ok and when prompted save the spreadsheet to a suitable location.

Open the spreadsheet and you’ll see stock codes in column A which is labelled cstockcode. The corresponding Sell Price is in column S which is labelled nsellprice. Amend the Sell Price for any items you wish to change ensuring that the structure of the spreadsheet isn’t altered in any way.

If you wish to use Excel to perform some calculations (such as increasing all prices by 10%) then copy the nsellprice column to another spreadsheet, perform the necessary calculations, and paste the results back using the Paste Values option.

Once you’ve finished amending prices, save the spreadsheet in the same format, which is Microsoft Excel 5.0/95 Workbook (.xls) and switch back to Back Office Accounts.

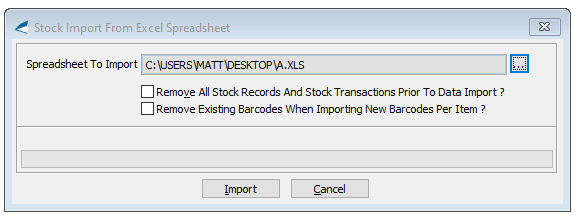

Go to Commercials -> Stock Control -> Utilities -> Import from Excel

Click on the Browse button and locate your amended spreadsheet

Click Import

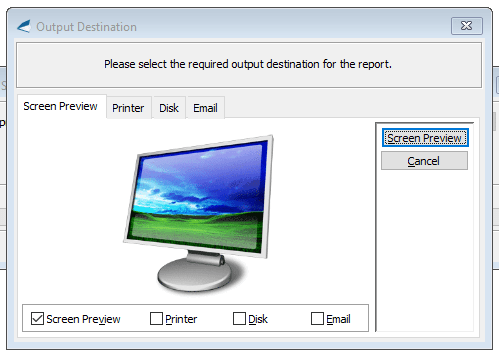

When prompted you can view a report of which records will be updated. For ease you can just select Screen Preview here

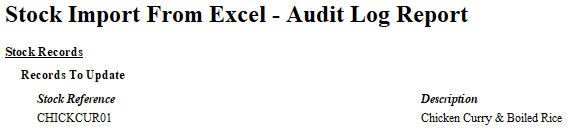

You’ll then be presented with the report

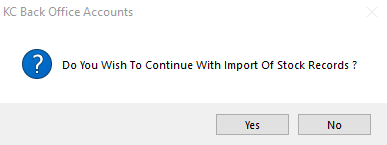

If you’re happy with the proposed changes then say Yes on the following prompt

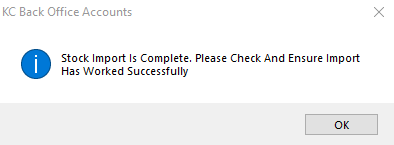

Once the import is finished, you’ll receive the following confirmation

Creating A New VAT Rate

You can’t actually create new VAT Rates in Back Office Accounts, but there are 12 (S, E, Z and 1-9) created as standard, so you just need to amend one which isn’t already in use.

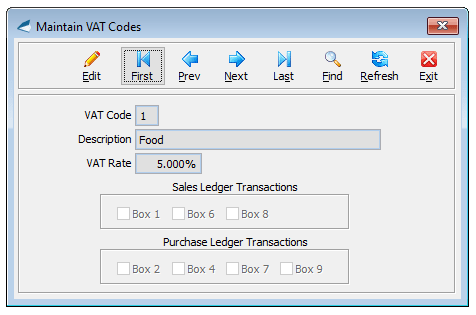

Navigate to Utilities -> VAT Control -> VAT Rates

Use the Prev / Next buttons to locate a Rate which isn’t already being used

Click Edit and set the Description and VAT Rate accordingly.

Click Save

VAT Inclusive Items

In Back Office Accounts you have the ability to flag an item as VAT Inclusive which is very convenient in a retail environment as it allows you to enter the Gross Price in the Sell Price field, which is what the customer will ultimately pay.

However, when using this option, it’s important to note that if the rate of VAT associated with the item changes, the price of the item itself will remain the same. If you want to pass on some of the costs or savings to your customer, then the price will need to be adjusted manually.

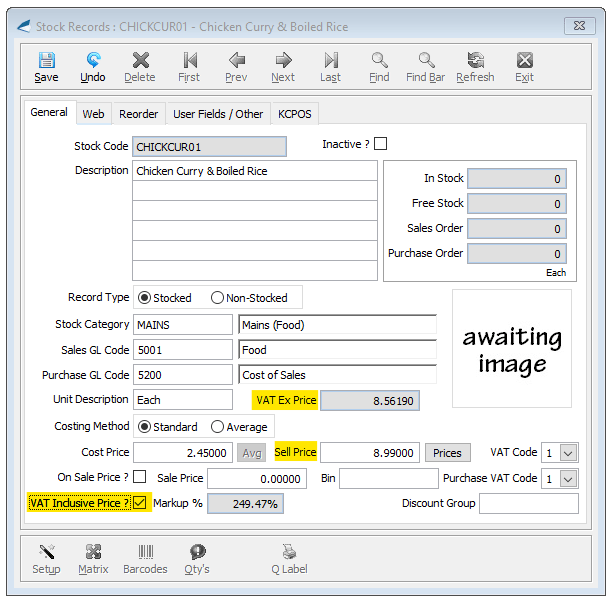

To change the VAT Inclusive Price status of an item, navigate to Commercials -> Stock Records

Use the Prev / Next buttons or the Find option to locate the item you wish to change the option on.

Click Edit and tick VAT Inclusive Price.

You’ll see that the read-only VAT Inc Price field is now renamed to VAT Ex Price so you can see the price of the item without any VAT included.

Click Save